Corporate Governance Survey 2020: On Good Governance Day, individual shareholders highlight key issues with Corporate Governance at listed Indian companies

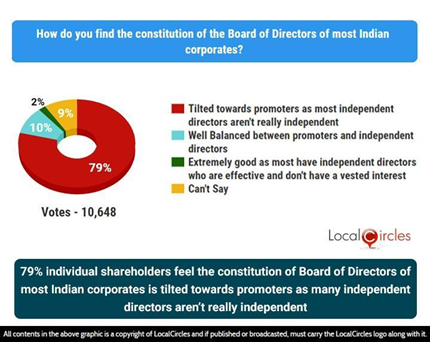

- ● 79% individual shareholders believe that constitution of the Board of Directors of most Indian corporates is tilted towards promoters as many independent directors aren't really independent

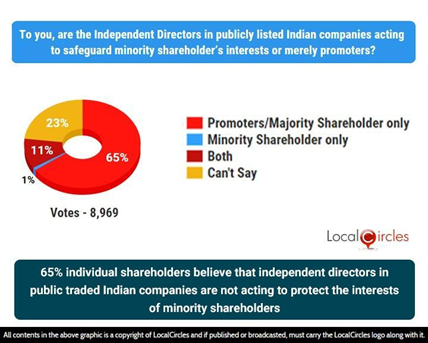

- ● 65% individual shareholders believe that independent directors in public traded Indian companies are not acting to protect the interest of minority shareholders

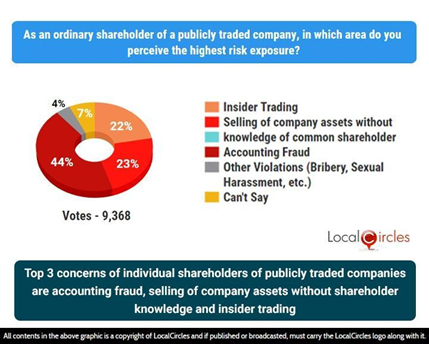

- ● Top-3 concerns of individual shareholders of publicly traded companies are accounting fraud, selling of company assets without shareholder knowledge and insider trading

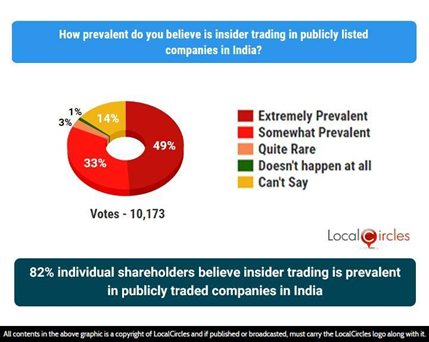

- ● 82% individual shareholders believe insider trading is prevalent in publicly traded companies in India

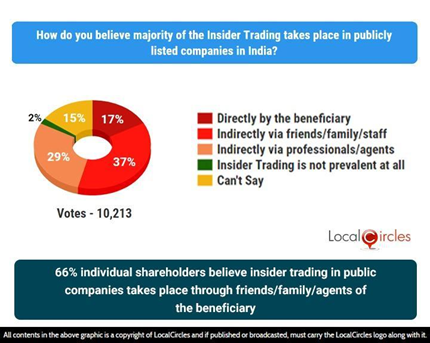

- ● 66% individual shareholders believe insider trading in public companies takes place through friends/family/agents of the beneficiary

65% individual shareholders believe independent directors in publicly traded companies are not acting to protect interests of minority shareholders; Accounting Fraud, Selling company assets, Insider Trading amongst top concerns

December 25, 2020, New Delhi: Corporations become a trusted force in the market when they follow effective corporate governance that adheres to a set of rules, policies, processes and laws to operate and are regulated or controlled by a trusted system. Practicing good governance can set businesses apart from competitors when it aligns the interests of the management with those of key stakeholders, shareholders, and its Board of Directors. Businesses that implement proper regulatory standards with regards to appointments, roles, compensation, evaluation of board of directors among others tend to prosper and earn higher levels of shareholder trust and in turn increase market capitalization than the ones who don’t. On the other hand, some companies perish because of weak corporate governance.

India has had its share of companies where weak corporate governance led to significant erosion of shareholder value as public markets punished them once the details of the fiasco became public. Satyam Computers, IL&FS, Punjab National Bank, ICICI Bank are just some examples where shareholders suffered because of governance failures or conflict of interest of management. Many of these corporations while on paper adhered to corporate governance codes for years, the reality was different and shareholders ended up facing the brunt of it.

After observing citizen posts on corporate governance over a 12-month period, LocalCircles conducted its Corporate Governance Survey 2020 to ascertain common shareholders’ pulse on the state of corporate governance in Indian corporations. Secondly, the survey attempts to gauge the perception of common shareholders on Insider Trading. The objective of this survey was to understand the perception of common shareholders on the role of independent directors and corporate governance and escalate them to the regulator for review and action. LocalCircles believes that if actions are taken in these areas, they will lead to increased trust of common citizens in markets and in turn lead to more citizens investing their savings in equity shares of public companies.

The survey received more than 48,000 responses from over 21,000 unique shareholders located across 272 districts of India. 71% respondents were men, while 29% respondents were women. 59% respondents were from tier 1, 25% from tier 2, and 16% respondents from tier 3, 4 and rural districts.

Are independent directors of the board really independent?

The Board of Directors in a public company are responsible for implementing adherence to corporate governance standards while delivering shareholder value over time. Although independent directors of the board do not have material or pecuniary relationships with the company, it is encouraged that they be more proactive in guiding companies in a profitable, socially responsible and environmentally sustainable manner. According to Comptroller & Auditor General of India (CAG), an auditing body for government finances that also looks at company’s compliances and performance, has developed standards and guidelines for environment audit, research accounting among others, and has carried out audits on a case to case basis.

One of the top concerns raised by citizens over time has been about the independence of an independent director and their relationship with promoters both at a personal and financial level. One of the first questions that was asked shareholders was “How do you find the constitution of the Board of Directors of most Indian corporations?”, To this question, 79% individual shareholders thought that the constitution of the Board of Directors of most Indian corporates is tilted towards promoters as many independent directors aren't really independent. There were as few as 10% who answered that it was well balanced between promoters and independent directors. Only 2% thought that the constitution was extremely good as most independent directors are effective and don’t have a vested interest. 9% of the common shareholders said they Can’t Say.

79% individual shareholders feel the constitution of Board of Directors of most Indian corporates is tilted towards promoters as many independent directors aren’t really independent

Do independent directors safeguard minority stakeholders’ interest?

One of the other concerns raised by common shareholders in the public discussions is that of the paper directors i.e. independent directors at publicly traded corporations who exist merely on papers and who get their retainer fee while participating in just a few of the board meetings and many times just skipping them altogether. According to shareholders, in some corporations such independent directors are friends, family or associates of the promoters and rarely raise difficult and pertinent governance issues.

The second question asked common shareholders, “To you, are the Independent Directors in the publicly listed Indian companies acting to safeguard minority shareholder's interests or merely promoters?”. 8,969 responses were received. Of which, the majority of 65% individual shareholders believe that independent directors in publicly listed Indian companies are not acting to protect the interest of minority shareholders. Only 1% thought that they were acting to protect the interest of the minority shareholder only while 11% thought that they were acting to protect the interest of both the promoters as well as the minority and common shareholders. 23% common shareholders responded with a Can’t Say. Such a high proportion of Can’t Say responses indicate another concern that many common shareholders lack clarity on the workings of the independent directors of companies whose shares they have invested their savings in.

65% individual shareholders believe that independent directors in public traded Indian companies are not acting to protect the interests of minority shareholders

Top-3 concerns of shareholders of public listed companies

The role of independent directors has come under question many times over the last few years. Alleged frauds at IL&FS, PMC Bank and Amrapali Group have been questioned as to how in some of these cases even seasoned directors were not able to foresee them. In the case of IL&FS the management was accused of fraud with intent to injure the interests of the company, its shareholders and lenders and the entire Board of 15 including several independent directors was sacked by the Government. More recently, the role of independent directors of Future Retail has been questioned and debated in courts.

According to people, Independent Directors should ideally be a voice that represents, especially minority shareholders’ interest and be their representative to ensure that all corporate governance norms are being adhered to by the company. They should play an active role in reviewing the work of auditors as well as the legal and compliance aspects of the company such that risk and conflict of interests are minimised and well documented. If they play their role effectively, according to people, it will lead to an increased confidence among any company’s investors and shareholders, which in turn will have a positive impact on market capitalisation of the company. Cases like Satyam Computers and recently IL&FS were examples of accounting frauds where the management with external accountants and auditors was found to be involved in misstating financials, the Board of Directors did not effectively question that state of affairs. The common shareholders were asked, “As an ordinary shareholder of a publicly traded company, in which area do you perceive the highest risk exposure?” 40% said “Accounting Fraud'', 21% each voted “Insider Trading” and “Selling of company assets without knowledge of common shareholders” as the top-3 concerns of individual shareholders of the public traded companies. Further, 2% voted “Other violations (Bribery, Sexual Harassment, etc.)”. 4% responded with a Can’t Say.

Top 3 concerns of individual shareholders of publicly traded companies are accounting fraud, selling of company assets without shareholder knowledge and insider trading

Are public listed companies free from Insider Trading?

Insider Trading is the illegal practice of trading on stock exchanges to one's own advantage after having access to confidential information which is not available with the common shareholder. The SEBI Act and the Companies Act have specified strict penalties for insider trading, with fines of three times the amount of profits made out via insider trading, and imprisonment up to ten years or both. Insider trading can lead to big movements in the trading of the share to common shareholders’ dismay.

Over the last year, LocalCircles has received many concerns from citizens about the prevalence of insider trading and how it benefits a handful of people. When the common shareholders were asked “How prevalent do you think is insider trading in India?”, 10,173 responses were received. Of which, 49% voted “Extremely prevalent”, while 31% found it ‘Somewhat prevalent’, 3% believed it was “Quite Rare” while 1% said it “Doesn’t Happen at All” and 14% responded in a Can’t Say. Overall, 82% common shareholders believe that insider trading is prevalent in publicly traded companies in India.

82% individual shareholders believe insider trading is prevalent in publicly traded companies in India

How Insider Trading takes place?

Citizens from time to time have raised issues on LocalCircles about insider trading being common and how quid pro quos are common when it comes to insider trading. Also, instances of indirect family and friends were cited and concerns were raised about these not getting tracked. When the survey asked common shareholders, “How do you believe the majority of Insider Trading takes place in publicly listed companies in India?”, 10,213 responses were received. Collectively 66% individual shareholders believe insider trading in public companies takes place through friends, family, staff or agents of the beneficiary, while 16% were of the opinion that it was done directly by the beneficiary. Only 2% voted, “Insider Trading is not prevalent at all” and 15% responded with a Can’t Say.

SEBI has implemented mandatory Insider Trading compliance codes for all listed company’s directors, vice presidents, managers, employees in finance and legal departments, personal assistants and secretaries of the company. Also, it has implemented a high-valued inter-market surveillance software, including Artificial Intelligence-based tracking mechanism to detect insider trading. The recent instance of Chennai-based Lakshmi Vilas Bank (LVB) is the latest to come under SEBI’s radar for alleged possibility that it violates disclosure norms, including insider trading rules. According to people’s perception though, insider trading is much more prevalent in India and a more proactive approach from SEBI could go a long way in minimising this malpractice.

66% individual shareholders believe insider trading in public companies takes place through friends/family/agents of the beneficiary

The above findings represent the pulse of common shareholders in India and provide regulators and corporates a plate full to act on. From ensuring that the independent directors are adding real value to the companies and looking after the interests of minority shareholders to ensuring that issues of insider trading are timely and effectively detected and acted upon. If these issues are addressed not only will Indian markets and corporates earn increased public trust they will see many more common citizens investing some of their savings in equities. Similarly, if corporate governance of Indian companies improves, it will most definitely attract an increasing number of foreign institutional investors into Indian markets.

LocalCircles will be escalating the findings of this study with the Ministry of Corporate Affairs and SEBI and any other relevant stakeholders so actions can be taken on them to improve corporate governance of Indian public companies.

Survey Demographics

The survey received more than 48,000+ responses from 21,000+ unique shareholders located across 272 districts of India. 71% respondents were men while 29% respondents were women. 59% respondents were from tier 1, 25% from tier 2 and 16% respondents were from tier 3, 4 and rural districts. The survey was conducted via LocalCircles platform and all participants are validated citizens who had to be registered with LocalCircles to participate in this survey.

About LocalCircles

LocalCircles, India’s leading Community Social Media platform enables citizens and small businesses to escalate issues for policy and enforcement interventions and enables Government to make policies that are citizen and small business centric. LocalCircles is also India’s # 1 pollster on issues of governance, public and consumer interest. More about LocalCircles can be found on https://www.localcircles.com

For more queries - media@localcircles.com, +91-8585909866

All content in this report is a copyright of LocalCircles. Any reproduction or redistribution of the graphics or the data therein requires the LocalCircles logo to be carried along with it. In case any violation is observed LocalCircles reserves the right to take legal action.