41% small businesses say impossible to file ITR by Dec 31st and want extension of deadline

- ● Only 13% individual taxpayers say impossible to file their returns by Dec 31st deadline

December 27, 2020, New Delhi: The Central Board of Direct Taxes (CBDT) has fixed December 31, 2020, as the deadline for individual and small business taxpayers to file their income tax return (ITR) for the financial year 2019-2020. The last date for filing ITR, which is usually on 31 July of each year, was extended due to Covid pandemic and subsequent lockdowns in the country. Most taxpayers have already started to clear their ITR, according to reports citing the Income Tax Department, over 4 crore ITRs for AY 2020-21 for individual tax payers have been filed till December 25, 2020. Failure to file ITR by 31 December 2020, could lead to a penalty of a minimum of 50% or a maximum of 200% of the assessed tax will be levied on the taxpayers. With the ITR filing last date approaching closer, many of the small businesses, who are yet to file returns, find themselves in a troublesome situation to file their ITR by the given deadline.

LocalCircles has conducted a survey to understand the pulse of taxpayers related to filing Income Tax Return by December 31, 2020. It also tried to understand small businesses' position in filing their ITR and audit report for FY 19-20 by the given deadline. The individual taxpayers survey received more than 6600 responses while the small business survey received more than 2300 responses.

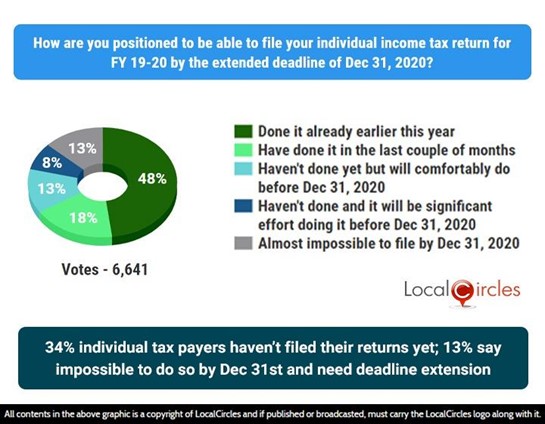

The first question in the survey asked individual taxpayers “How are you positioned to be able to file your individual income tax return for FY 19-20 by the extended deadline of December 31, 2020?” 6,641 responses were received. Of which, 48% of individual taxpayers said they have done it already earlier this year, 18% said they have done it in the last couple of months. 13% voted for “haven’t done yet but will comfortably do before December 31, 2020”. Other 13% of citizens said that it is almost impossible to file by December 31, 2020, while 8% believed that it would take significant effort doing it before the deadline. Per aggregate views of citizens, the survey finds that 34% individual taxpayers haven’t filed their returns yet, while 13% say that it will be impossible to file their return by December 31, 2020, and hence want an extension of the deadline.

34% individual tax payers haven’t filed their returns yet; 13% say impossible to do so by Dec 31st and need deadline extension

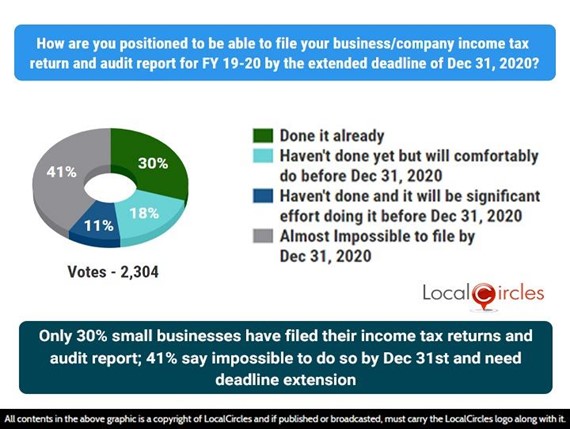

The following question asked small businesses “How are you positioned to be able to file your business or company income tax return and audit report for FY 19-20 by the extended deadline of December 31, 2020” and received 2,304 responses. Notably, 41% of respondents believe that it is almost impossible to file it by December 31, 2020. Furthermore, 30% of respondents said they have done it already, 18% haven’t done yet and will comfortably do before the deadline, while 11% believed that it will take significant effort doing it before the deadline of December 31. Per aggregate views of small businesses, only 30% small businesses have filed their income tax returns and audit report, while 41% said it is impossible to do so by December 31 and need a deadline extension.

Small businesses have had a highly challenging year this year due to the COVID-19 pandemic with lockdown for the months of April-May and extremely slow period from June – August as economic activity and consumer demand was significantly impacted. It is only after September when signs of pick up in business activity emerged and for many small businesses it has been about recovering some of the accumulated losses from March – August this year. Also, for many small businesses, there is dependency on GST returns and business returns are typically more complicated than individual returns and for many of them, they require several sittings and information exchange with their accounting professionals which has become difficult due to the pandemic. Small Businesses are keen that the deadline be extended to Feb 28, 2021 and at the very least till Jan 31, 2021.

Only 30% small businesses have filed their income tax returns and audit report; 41% say impossible to do so by Dec 31st and need deadline extension

LocalCircles recommends that the Government should consider the request of the small businesses given that 41% of them believe its impossible for them to file by Dec 31 and another 11% feel it will be a significant effort filing by Dec 31. However, on the individual income tax returns, LocalCircles recommends that if anything an additional week may be given since only 13% individual taxpayers find it impossible to file by Dec 31.

LocalCircles will be escalating the findings of this study with the Ministry of Finance leadership so due consideration can be given to the ask of small businesses and individual taxpayers.

Survey Demographics

The individual taxpayers survey received more than 6600 responses from citizens located in 207 districts of India while the small business survey received more than 2300 responses from businesses located in 102 districts of India. The survey was conducted via LocalCircles platform and all participants are validated citizens who had to be registered with LocalCircles to participate in this survey.

About LocalCircles

LocalCircles, India’s leading Community Social Media platform enables citizens and small businesses to escalate issues for policy and enforcement interventions and enables Government to make policies that are citizen and small business centric. LocalCircles is also India’s # 1 pollster on issues of governance, public and consumer interest. More about LocalCircles can be found on https://www.localcircles.com

For more queries - media@localcircles.com, +91-8585909866

All content in this report is a copyright of LocalCircles. Any reproduction or redistribution of the graphics or the data therein requires the LocalCircles logo to be carried along with it. In case any violation is observed LocalCircles reserves the right to take legal action.